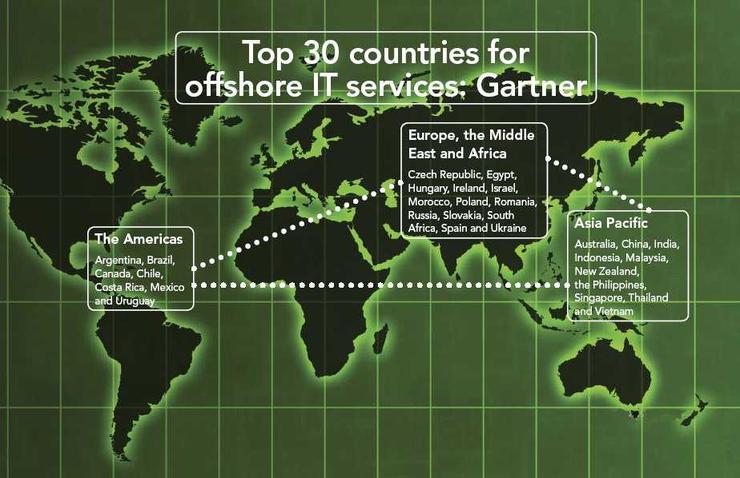

Gartner's top 30 countries for IT services

In Australia, CIOs are trying to get more from their existing outsourcing arrangements. Clients and incumbent vendors are renegotiating deals before they expire; both recognising they can save money by avoiding the competitive chore of going to market and rebuilding a better deal.

Success, however, is elusive.

Clients may want to cut a new deal, but few vendors have the flexibility to move from their current service delivery models. Vendors are influenced by the day-to-day pragmatism of their business-as-usual team, rather than the creativity of their sales people.

John Liburti is the founding director of Cherub Consulting Group, whose recent clients include BHP Billiton, National Foods, Mitsubishi Motors, Westpac, Woodside, and the University of Melbourne. Liburti’s specialty is strategic sourcing. He says the big challenge is client expectation; Often, clients want the new deal to deliver the future today. But a renegotiation is about changing an old deal, not building a new one.

“Either way, the move is a change in the dance step, rather than a change in the dance beat,” says Liburti. “Where vendors fail is that they understand change is required, but they can’t demonstrate the journey to the client. How do we get there? What are we going to do that is different? The result is that clients see the renegotiation is doomed so they go to market.”

Organisations are also starting to re-invest in their own people rather than rely on vendors. They are rebuilding internal teams by hiring a new breed of IT expert; not people expert in doing the work — that’s the reason they outsourced in the first place — but people who are experts in identifying internal business needs, extracting information from advisors, filtering feedback, and converting it into intelligence that helps the CIO build a strategic IT roadmap for the business.

“You don’t want your people ‘doing’; you want them ‘managing’,” says Liburti. “That means vendor management, which is one area most organisations neglect. They think a contract is all they need. Most outsourcing deals that go wrong reveal there is as much blame with clients as with vendors.”

Organisations are recognising vendor management as a way to evolve the contract, as opposed to just keeping it humming. They are building their ability to manage vendors and improve their understanding of their own business. Smaller and shorter deals are back in vogue, Liburti says, since they are easier to manage and more flexible. Most clients are looking to reduce the value and duration of their contracts to achieve faster implementations, and more responsive exit and change strategies.

“There is no point having long deals that you are locked into if you are trying to change the way you do things,” says Liburti.

Clients are also seeing the value of building an in-house project management capability, not only to manage internal resources, but to manage vendor projects to their organisation, in order to maximise the visibility of costs, the quality and the vendor activity.

Standardised processes, training, consistent reporting, portfolio management, and project prioritisation are all becoming the norm in organisations that historically relied on vendors to provide these tools, skills and disciplines.

Read part 1 of CIO Australia's outsourcing series.

Join the CIO Australia group on LinkedIn. The group is open to CIOs, IT Directors, COOs, CTOs and senior IT managers.