Startup wants to be Australia's Mint.com

- 08 January, 2013 14:12

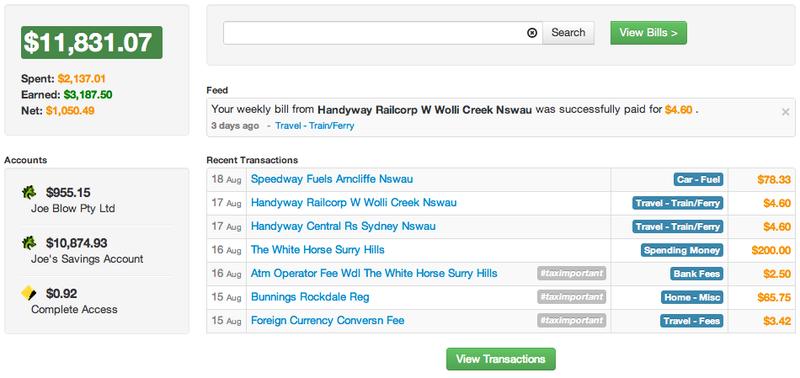

Pocketbook, a Sydney-based startup, seeks to build a simpler and more useful service for managing spending compared to current offerings in Australia.

The financial planning service, now in private beta, lets users import account data from top national banks and others, and will soon integrate Coles and Woolworths reward programs.

Some banks provide similar services, “but nothing is very easy to use or of much value besides showing your balance and transferring money,” Pocketbook co-founder, Bosco Tan, told Computerworld Australia.

Pocketbook aims to be “ridiculously simple.” Pocketbook works similarly to Mint.com, which was purchased by Quicken-maker Intuit in 2009. Currently, Mint only supports US and Canadian financial institutions.

Tan developed Pocketbook with business partner and programmer Alvin Singh. Singh pitched Pocketbook at SydStart, a local startup event, and “got a lot of interest,” Tan said. Since then, they have been developing and expanding the software.

Pocketbook currently can import bank feeds from Westpac, Commonwealth Bank, ANZ bank, National Australia Bank, St George, Bankwest, ING Direct and GE Money’s 28 Degrees Mastercard. Tan expects in the next month to add Citibank, Ubank and Suncorp, he said.

“We want to get the experience absolutely right at a local level,” Tan said. After that, the service could expand to New Zealand and other countries, he said.

Pocketbook is able to pull data from the banks automatically through Internet banking. However the company is meeting with banks to talk about how to enhance compatibility, he said.

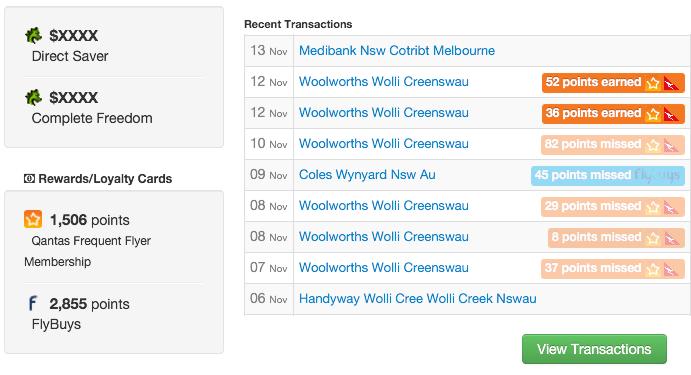

The startup will soon add reward points integration with Coles FlyBuys and Woolworths Everyday Rewards, Tan said.

“The integration will allow individuals to see where they earned points and also where they potentially missed earning points,” he said.

A recently added feature is a tool that can analyse and categorise a user’s spending, and the startup is looking at adding a budgeting feature, he said.

Pocketbook currently sends weekly financial updates through email but may eventually add support to do it through Apple Passbook, Tan said.

Android users will be able to access the same card through a free app called PassWallet that ports Passbook cards to the Google platform.

Pocketbook is read-only, so no money can be moved using the service, and Tan said he’s found that people are willing to input bank information because of the usefulness of the product.

However, he said trust and security are important to Pocketbook’s success.

Pocketbook uses asymmetric encryption keys and offline key storage for sensitive data, hashing functions using adaptive timed iterations, SSL and hardened servers, among other security techniques, Tan said. The site runs on CloudFlare to further bolster security, he said.

At this point, Pocketbook’s marketing is mostly based on word of mouth. The company uses an invite-a-friend button on the website to encourage viral promotion of the site.

Tan believes an opportunity for monetisation lies in making relevant recommendations to users. For example, if the site sees that a customer has been charged a foreign transaction fee for booking a trip to Hawaii with a credit card, the site could suggest another card that doesn’t have the same fee, he said.

“A lot of that intelligence around optimising spending isn’t there in the marketplace at the moment,” he said.

Pocketbook could also potentially be of use to financial planners and accountants who want to see a single view of a customer’s finances, Tan said. Currently, they have to pull up each of a customer’s financial institutions individually. Pocketbook could in the future provide a read-only view of users’ accounts for those advisers, he said.

The Silicon Beach

Tan said he’s upbeat on the state of Sydney startup scene. “There’s a whole lot of things happening that a couple years ago were unthinkable."

Accelerators in Sydney are getting more mainstream media attention, Tan said. And large corporations such as Telstra, SingTel/Optus and Westfield are setting up funds for Australian startups, he said.

Whether startups must move to Silicon Valley to find success has been a major topic of debate in Australia.

“It’s still so much easier to get funding,” and more of it, in Silicon Valley in the US, Tan said. There’s also more hesitation from consumers to give Australian startups a try compared to those in Silicon Valley, he said.

“At the same time, I think the [Australian] government is doing some smart things” including providing grants to Australian startups, he said.

“It’s definitely moving in the right direction.”

Follow Adam Bender on Twitter: @WatchAdam

Follow Computerworld Australia on Twitter: @ComputerworldAU, or take part in the Computerworld conversation on LinkedIn: Computerworld Australia