HP rules as Aussie PC market bounces back

- 14 March, 2017 10:29

The HP Customer Welcome Centre in Sydney

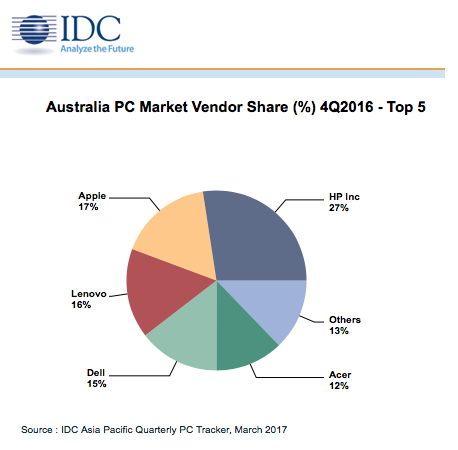

HP continues to hold the top position in the Australian PC market, after reporting a leading share of 27.4 per cent during the fourth quarter of 2016, as the industry bounces back to health.

Largely aided by superior performance in education and public sector, the tech giant maintained a sizeable cushion of around 10 per cent locally during period, ahead of Apple who remained in second position.

According to IDC findings, Apple holds a share of 16.9 per cent, with the majority of its growth coming from national retail.

Meanwhile, Lenovo maintained its third position, same from previous year, at 16.1 per cent with Dell and Acer completing the top five ranks, ending at 14.5 per cent and 12.2 per cent respectively.

Acer gained about 4.4 per cent market share from previous year, with a consistent growth in consumer and education segment, including a large Chromebook deployment.

HP’s continued dominance follows news that the PC market in Australia is stabilising, performing better than expected during the fourth quarter of 2016.

Specifically, PC shipments across the country totalled 1.12 million units (desktop and notebook) during the period, posting a year-on-year (YoY) decline of 3.2 per cent.

According to IDC, the local market performed better than expectations, in comparison to the previous forecast of -10.2 per cent.

Annually, shipments of traditional PCs slipped to 4.01 million units, down by 7.2 per cent from 2015.

As outlined by IDC, the first half of 2016 was still constrained by Dick Smith’s exit, high inventory and free Windows 10 upgrades.

However, the market bounced back in the second half of 2016, with significant hardware refreshment push, both within enterprise and public sector.

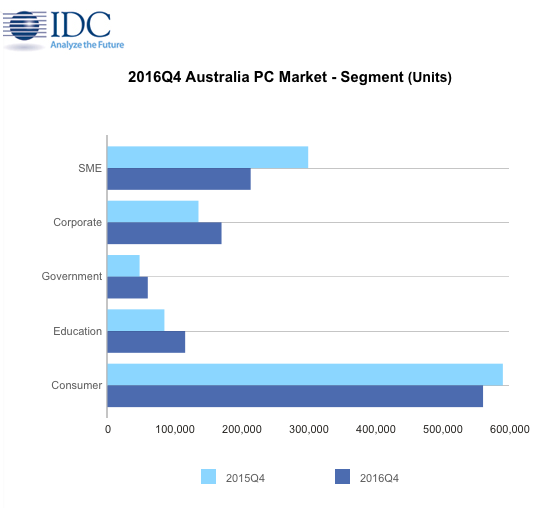

Meanwhile, the commercial segment posted a decline of 1.4 per cent during the period.

“Bring your own device (BYOD) seems to be fading away, particularly within the education segment, as several state education departments have returned to centralised purchasing policy,” IDC Australia Client Devices Analyst, Sagar Raghavendra, said.

“The result is evident, as the education segment posted a growth of 36.4 per cent YoY.”

In addition, public sector grew by 25.6 per cent YoY followed by growth in corporate segment at 25.3 per cent YoY, while on the other hand, the SMB segment declined by 28.7 per cent YoY.

“Windows 10 free upgrade seems to have helped the SMBs to extend their hardware refresh cycles resulting in a downward curve for SMBs,” Sagar added.

In addition, the consumer segment declined by five per cent YoY.

“Microsoft and Intel’s continued incentivisation to OEMs seem to have helped alleviate the decline in the market, as this segment performed better than original forecast,” Sagar added.

The notebook PC market remained flat YoY, with the convertible form factor continuing to drive growth, posting a YoY growth of 41.8 per cent.

Desktop PC declined by 10.8 per cent despite more demand for small/micro small form factor.

“The market responded well to Intel’s Skylake processor launch in late 2015,” Sagar added. “The same was not visible with the Kabylake processor launch at the end of 2016, as the desktop PC market attracted only a lukewarm response.”

Looking ahead, Australia PC shipments are forecast to decline by 5.5 per cent 2017, followed by a relatively softer decline of 3.5 per cent in 2018.